Lifestyle Drawbacks of Renting vs. Buying a Home: What You Need to Know

Introduction: Understanding the Lifestyle Drawback of Renting

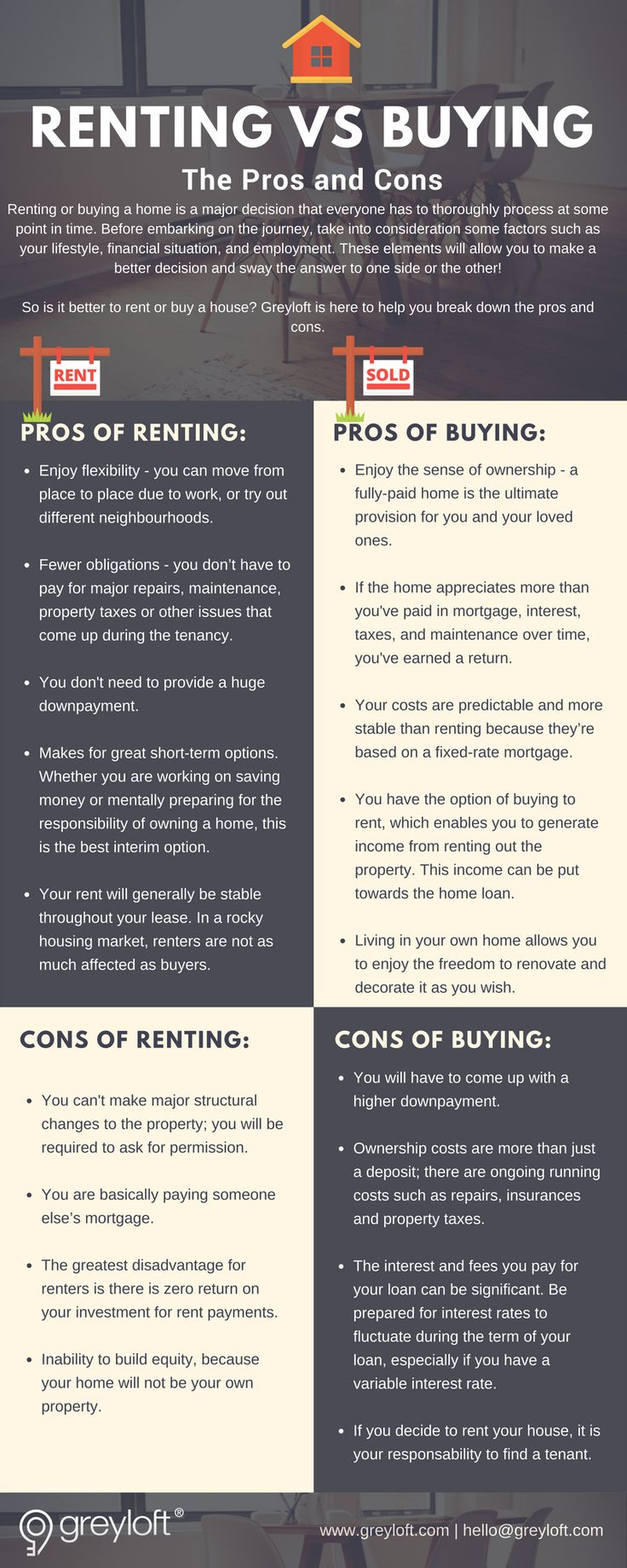

Choosing between renting and buying a home is one of the most important lifestyle decisions you’ll make. While renting offers unique advantages-like flexibility and lower upfront costs-it comes with notable drawbacks compared to homeownership. This article explores the primary lifestyle limitations of renting versus buying, provides real-world examples, and offers actionable guidance for those considering their next move.

Limited Control Over Your Living Space

One of the most significant lifestyle drawbacks to renting is the lack of control over customization . Renters are often restricted from making major changes to their living space, such as painting walls, upgrading appliances, or renovating rooms. These limitations stem from the property owner’s rules and lease agreements, which typically prohibit permanent modifications without approval. For individuals who value personalizing their environment, this can make rented spaces feel less like home [1] .

Example:

A family renting an apartment may want to convert a spare room into a home office but is unable to install built-in shelves or change the flooring due to lease restrictions. As a homeowner, these changes would be entirely at their discretion.

Implementation Guidance: If customization is important to you, carefully review lease terms before signing. Discuss potential improvements with landlords and get written permission when possible. Consider searching for rental properties that allow limited customization or seek a path to homeownership for full control over your space.

No Long-Term Equity or Investment Potential

Renting does not allow you to build equity or benefit from property appreciation. Each monthly rent payment goes directly to the landlord, with no return on investment for the tenant. In contrast, homeowners gradually accumulate equity and can profit from rising property values over time [2] , [1] . This financial disadvantage can have long-term implications for wealth building and retirement planning.

Example:

Over a decade, a renter might pay $150,000 in rent, with none of that contributing to ownership. A homeowner, however, would see their mortgage payments build equity and could potentially sell the home for a profit in the future.

Actionable Steps: If you choose to rent, consider setting up automatic transfers to a dedicated investment account. This disciplined approach helps compensate for the lack of equity building inherent in renting. Consult a financial advisor to explore stocks, bonds, or retirement accounts as alternative wealth-building strategies.

Instability: Risk of Rent Increases and Forced Relocation

Renters face unpredictable housing costs and the possibility of being asked to move. Unlike a fixed-rate mortgage, rent can increase annually or even more frequently based on market trends and landlord decisions [1] , [5] . Additionally, landlords may choose not to renew leases, leaving tenants searching for new homes-sometimes on short notice.

Example:

A renter in a rapidly growing city may experience a 15% increase in rent after a year, forcing them to seek more affordable housing or relocate to a less desirable neighborhood.

Practical Guidance: Before signing a lease, ask about the landlord’s policy on rent increases and renewal terms. Request longer-term leases if available and budget for potential increases. For added security, maintain a list of alternative housing options and monitor the local rental market regularly.

Dependence on Landlord for Maintenance and Repairs

Another lifestyle drawback to renting is the limited control over maintenance and repairs . Tenants must rely on landlords to address issues ranging from broken appliances to plumbing problems. The timing and quality of repairs depend on the landlord’s priorities, which can result in delays or unresolved problems [1] , [5] .

Source: physiowest.net.au

Example:

If your heating system fails during winter, you must notify the landlord and wait for repairs. As a homeowner, you could address the issue directly and immediately.

Source: shutterstock.com

Implementation Steps: When renting, document all maintenance requests and follow up regularly. Research local tenant rights organizations for guidance if repairs are delayed. If persistent issues occur, consider seeking legal advice or locating rentals managed by reputable property management companies with strong maintenance records.

Lack of Tax Benefits

Homeowners may qualify for significant tax deductions , such as mortgage interest and property taxes, which can reduce the overall cost of homeownership. Renters, however, do not receive these financial benefits [1] , [5] . While renters may have lower upfront costs and fewer responsibilities, missing out on these deductions can be a drawback, especially for those seeking long-term savings.

Example:

A homeowner with a $300,000 mortgage may deduct thousands in interest payments and property taxes each year, while renters see no such benefit.

How to Access Related Benefits: Renters might find some financial relief through state or local programs offering rent credits or rebates, particularly for low-income households. To explore such opportunities, search for “rental assistance programs” or contact your local housing authority for information on available benefits.

Limited Stability and Community Ties

Renters often lack the long-term stability that comes with homeownership. The possibility of moving frequently can disrupt social connections, involvement in local organizations, and a sense of community belonging. Homeowners are more likely to establish deep roots and participate in neighborhood activities [4] .

Example:

Families renting in a school district may be forced to change schools if they relocate, impacting children’s friendships and academic continuity.

Guidance for Strengthening Community Ties: Renters can still engage with local groups, schools, and events. Attend neighborhood meetings and volunteer for community projects to build relationships, regardless of housing tenure.

Alternatives and Solutions

If the drawbacks of renting outweigh the benefits for your lifestyle, consider the following alternatives:

- Rent-to-Own Programs: Some landlords offer rent-to-own agreements, allowing renters to build equity gradually. To find such programs, search for “rent-to-own homes” in your preferred area or consult local real estate agents for options.

- Co-Ownership: Partnering with family or friends to purchase a property can reduce upfront costs and divide responsibilities. Research “co-ownership agreements” for guidance on legal requirements and financial arrangements.

- Saving for Homeownership: If buying is a future goal, create a savings plan. Set up regular contributions to a dedicated account and explore down payment assistance programs by contacting your state’s housing finance agency.

Step-by-Step Guidance for Navigating Your Housing Options

- Assess your priorities: Flexibility, stability, customization, and financial growth.

- Calculate your budget: Include rent, utilities, insurance, and potential rent increases. Use home affordability calculators from reputable financial institutions such as Bankrate.

- Research local market conditions: Compare average rents with mortgage payments and property prices.

- Explore alternative paths: Rent-to-own, co-ownership, or savings plans for buying.

- Consult with professionals: Real estate agents, financial advisors, and housing counselors can provide personalized guidance.

- Monitor changes: Stay updated on rental laws, market trends, and assistance programs by following official government agencies and local housing authorities.

Key Takeaways

The primary lifestyle drawbacks to renting versus buying include limited control over your living space, lack of equity and investment potential, risk of rent increases and forced relocation, dependence on landlords for maintenance, absence of tax benefits, and reduced long-term stability. By understanding these limitations, you can make informed decisions and take actionable steps to align your housing situation with your long-term goals.