Understanding STR in Real Estate: A Comprehensive Guide to Short-Term Rentals

Introduction to STR in Real Estate

In the ever-evolving real estate landscape, STR stands for Short-Term Rental , a term referring to properties leased for brief periods-typically fewer than 30 days but sometimes up to six months depending on local regulations. The rise of digital platforms like Airbnb and VRBO has led to a dramatic increase in STR opportunities for both property owners and travelers, transforming traditional notions of lodging and investment. [1] [2] [3]

What Is an STR?

An STR is any property-house, condo, apartment, or even unique spaces like cabins and houseboats-rented out for short periods. Unlike traditional hotels and long-term leases, STRs offer guests a unique, home-like experience, often with amenities such as kitchens, private parking, and personalized touches. The flexibility and variety available have made STRs appealing to vacationers, business travelers, and even those relocating temporarily. [5] [4]

STR vs. LTR: Key Differences

Understanding the distinction between STRs and

Long-Term Rentals

(LTRs) is critical for investors and property owners. LTRs typically involve leasing for several months or years, offering steady, predictable income. In contrast, STRs can deliver higher returns due to premium nightly rates, but require more active management and are subject to seasonal demand fluctuations.

[4]

For example, a beachside condo listed on Airbnb may generate significantly more income during peak tourist season than it would under a year-long lease. However, this comes with increased turnover, cleaning, and guest communication responsibilities.

Popular STR Platforms and How They Work

Platforms such as Airbnb , VRBO , and HomeAway have revolutionized the STR market. These companies do not own properties; instead, they connect owners with guests, offering tools for listing, booking, payment processing, and guest management. [1] [2]

Key features include:

- Professional photography and listing optimization

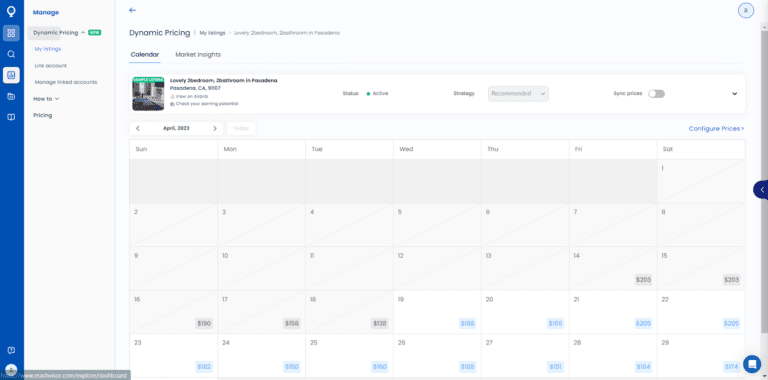

- Seasonal and dynamic pricing tools

- Guest review systems for credibility

- Host recognition programs, such as Airbnb’s Superhost and VRBO’s Premier Partner status, which can boost visibility and booking rates

Benefits of Investing in STRs

Investing in STRs offers several compelling advantages:

- Higher Income Potential: Well-managed STRs can yield greater returns than traditional LTRs, especially in high-demand areas. [3]

- Flexibility: Owners can block out dates for personal use, offering lifestyle benefits alongside investment returns.

- Market Responsiveness: Dynamic pricing allows owners to capitalize on peak seasons and adjust for market changes.

For example, a property in a popular ski town may command premium rates during winter months, maximizing income with strategic calendar management.

Regulatory Considerations and Compliance

STRs are subject to local laws and regulations, which can include licensing requirements, occupancy limits, and zoning restrictions. These rules vary widely by city and can change frequently. [2] [4]

For example, cities like Oakland and Berkeley in California have implemented strict regulations, including registration requirements and potential fines for non-compliance. Before listing a property as an STR, owners should:

- Contact their city’s housing or planning department to confirm current rules

- Review occupancy taxes and business licensing requirements

- Monitor periodic updates to local ordinances

If uncertain, owners can find up-to-date regulations by searching for “[city name] short term rental regulations” on their municipality’s official website or by consulting a local real estate attorney for guidance.

Source: confusedwords.org

How to Get Started With STR Investment

Launching an STR property involves several steps:

- Research Local Market: Analyze demand, competition, and seasonal trends using real estate data platforms or consulting local agents.

- Verify Legal Compliance: Register with city authorities, obtain permits, and ensure the property meets safety standards.

- Prepare the Property: Furnish and equip your rental to exceed guest expectations (clean linens, stocked kitchen, Wi-Fi, safety features).

- List on STR Platforms: Create compelling profiles on verified sites like Airbnb and VRBO, utilizing professional photos and detailed descriptions.

- Set Dynamic Pricing: Use platform tools or third-party services to adjust rates based on demand and seasonality.

- Manage Guest Experience: Respond promptly to inquiries, maintain high cleanliness standards, and solicit guest feedback for improvement.

Alternative approaches include hiring a property management company specializing in STRs to handle day-to-day operations, which may be ideal for owners seeking passive income without hands-on involvement.

Potential Challenges and Solutions

STR investment is not without obstacles. Common challenges include:

- Regulatory Risks: Sudden changes in local laws may restrict or ban STRs. Solution: Stay informed and maintain compliance to avoid fines.

- High Turnover: Frequent guest changes require diligent cleaning and maintenance. Solution: Hire reliable cleaning services and automate turnover schedules.

- Guest Management: Handling bookings and addressing guest issues can be time-consuming. Solution: Use platform tools or third-party property managers to streamline communications.

- Seasonal Demand Variability: Income can fluctuate with travel patterns. Solution: Diversify listings and offer incentives during slow periods.

Alternative Approaches to STR Investment

While direct ownership and management is common, alternatives include:

- Co-hosting: Partnering with experienced hosts to manage your property for a percentage of the revenue.

- REITs and Real Estate Funds: Investing in publicly traded entities focused on STR markets for diversified exposure.

- Corporate Housing: Targeting business travelers with longer but still short-term stays, often yielding stable occupancy.

Each approach has its own risk and reward profile; choose the strategy that aligns with your financial objectives and desired level of involvement.

Accessing STR Opportunities and Resources

To explore STR investment or hosting opportunities, consider these steps:

Source: es.learniv.com

- Visit verified STR platforms like Airbnb and VRBO for up-to-date information and listing tools.

- Consult local real estate professionals for market insights and compliance guidance.

- Search your city’s official website for current short-term rental regulations and licensing procedures.

- Review investor guides from reputable real estate publications and associations for best practices and case studies.

If you have specific questions about local requirements, contact your municipality’s housing department or seek advice from a licensed real estate attorney with experience in short-term rentals.

Key Takeaways

STRs represent a dynamic and potentially lucrative segment of the real estate industry, offering flexibility and higher income for owners willing to navigate regulatory and operational complexities. With proper research, compliance, and attention to guest experience, STR investment can be a rewarding strategy for both new and seasoned investors.

References

- [1] Macoy Capital (2021). STR in Real Estate: What You Need to Know.

- [2] Winkler Real Estate Group (2023). What does STR mean in Real Estate?

- [3] Mashvisor (2023). What Does STR Mean in Real Estate? A Guide.

- [4] Autohost (2024). LTR vs STR: Pros, Cons, and Insights for Real Estate Decisions.

- [5] Get Chalet (2024). What Does STR Mean in Real Estate? A Complete Investor’s Guide.